our mission: to create wealth for shareholders

The experienced management team is a key driver of this strategy – Geoff Wilding’s arrival as Chairman in 2012 saw a step-change in the scale and profitability of the business. Victoria management are rigorous in their enforcement of the acquisition criteria in search of sustainable growth and value creation for shareholders. The company delivers growth by operating as follows:

- The Company supplies the mid-to-high end of its respective markets, selling primarily direct to retailers. Its 3000+ UK customers range from independent retailers to distributors and large format chains like John Lewis.

- The business is overwhelmingly focused on the home improvement market, insulating it from the more cyclical industries like construction.

- The Company’s manufacturing facilities are well-invested and highly efficient. With only 10% of its cost base fully fixed, the business is able to respond quickly to changes in demand.

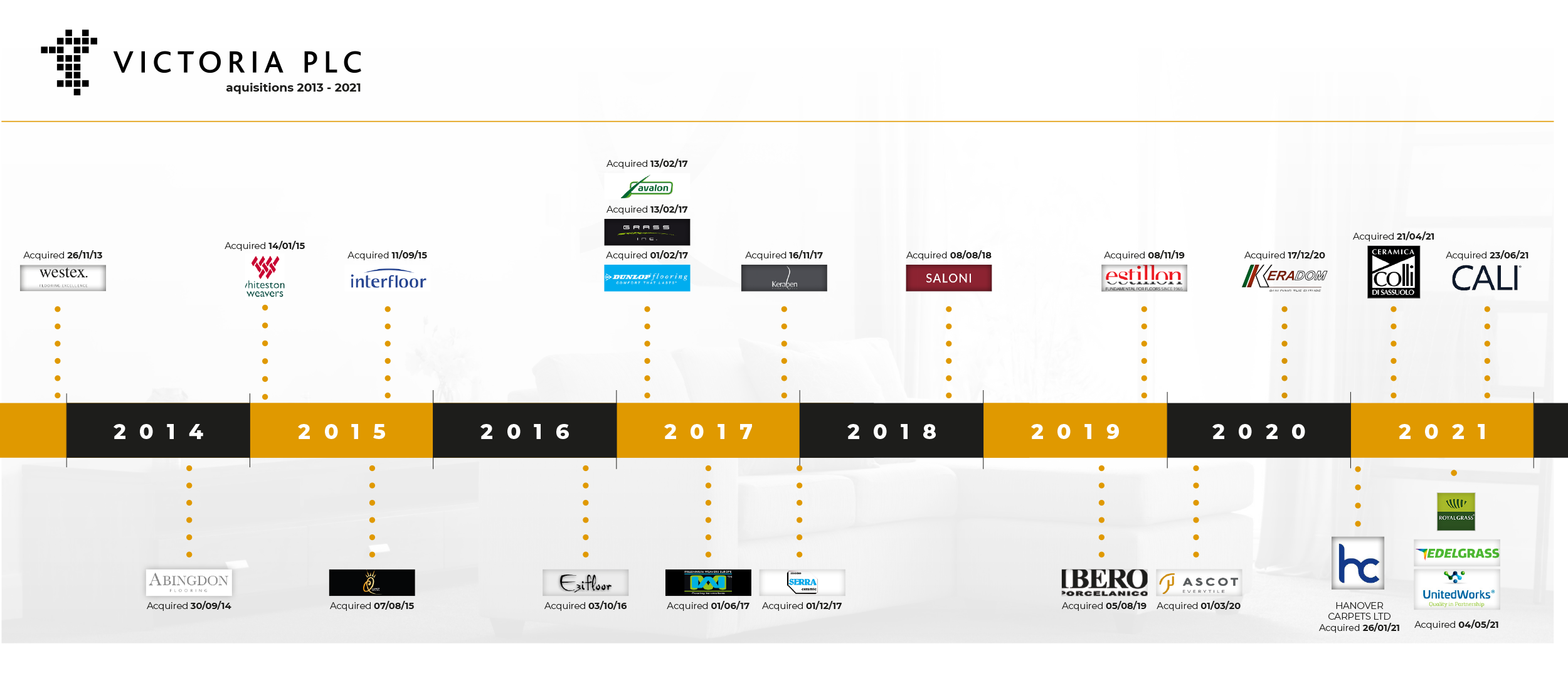

- Victoria PLC has a demonstrable track record of integrating acquired businesses and using cashflow to de-lever.

- Commercial synergies include leveraging the distribution networks and the ability to cross-sell bundled products, such as underlay.

Organic growth in the business is fundamentally driven by the five pillars of the business model. In addition, the Group continues to seek and deliver synergies and transfer best operating practice between acquired businesses, both in terms of commercial upside, and cost and efficiency benefits to drive like-for-like margin improvement.

Superior customer offering

Offering a range of leading quality and complementary flooring products across a number of different brands, styles and price points, focused on the mid-to-upper end of the market or specialist products, as well as providing market-leading customer service.

Sales driven

Highly motivated, independent and appropriately incentivised sales teams across each brand and product range, ensuring delivery of a premium service and driving profitable growth.

Flexible cost base

Multiple production sites with the flexibility, capacity and cost structure to vary production levels as appropriate, in order to maintain a low level of operational gearing and maximise overall efficiency.

Focused investment

Appropriate investment to ensure long-term quality and sustainability, whilst maintaining a focus on cost of capital and return on investment.

Entrepreneurial leadership

A flat and transparent management structure with income statement ‘ownership’ and linked incentivisation, operating within a framework that promotes close links with each other and with the PLC Board to plan and implement the short and medium-term strategy.